Part 1 — Progressive vs Regressive Tax Policy

Nobody likes taxes. But taxes are a reality. Americans recognize that to have a well functioning society, we need the government to perform some vital functions and those functions have a cost. How the government spends tax revenue is not the topic of this post. A statement like “the government already gets enough they just need to spend it better” is a moot point in a tax policy argument. Questions with how tax revenue is spent is not relevant to this conversation. The government will collect about $5.5 trillion in taxes this year, by whatever means it deems necessary. If the government must tax its citizens, how should it be done in the fairest and most productive way possible? Who’s tax policy is better, Biden’s or Trumps? To answer these questions, its helpful to provide a background of US tax policy and to provide a few definitions.

First, what are regressive and progressive tax policies and which is better?

A regressive tax policy has a larger tax burden as a percentage of income than on wealthier Americans. Graphically, it would look like this:

Regressive tax policies are problematic. A regressive tax policy shifts too much of the tax burden from the wealthy to the middle class and poor. Aside from issues of fairness, a regressive tax policy contributes to income inequality, poverty, and can be a contributing factor to issues that arise from poverty like shorter life expectancy and higher crime. Additionally, the middle class is America’s consumer. If the middle class are over-taxed, they are less able to purchase goods and services, and the economy as a whole suffers.

A progressive tax policy is defined by an increasing burden of tax as a percentage of income as income increases. Graphically, this is an example of a progressive tax system:

Overly progressive tax policies are problematic too. Progressive tax policies shift the tax burden to wealthier taxpayers. Shifting too much burden to wealth taxpayers could lead to slower rates of capital formation that create growth, and a higher incentive for those taxpayers to shift income to other tax jurisdictions.

As with most economic issues, its around finding the right balance. Later I will explore the economic rationale for both regressive and progressive tax policies in more detail, but for now its fine to know that neither very progressive nor very regressive is good.

So where do we stand today? The current tax policy under Trump’s Tax Cuts and Jobs Act are flat to slightly progressive for the working and middle class, but become more and more regressive (favorable to the wealthy) as income increases. I’ve depicted CURRENT tax rates two ways below, both excluding and including the cost of employee paid health insurance premiums.

Notably, the peak rate as a percentage of income is at the 82nd percentile, our around $102,000 in income. Should we really be taxing working families with two earners making $51,000 a year more than ANY other taxpaying group?

Below: Current Tax Rates EXCLUDING health insurance premiums

Below: Current Tax Rates INCLUDING health insurance premiums

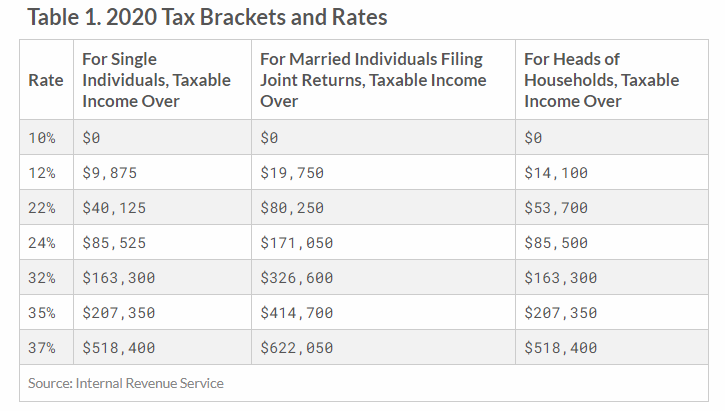

The graphs above may surprise you. Most American’s are loosely familiar with Federal Income tax rate chart (below), which is very progressive, and probably assume that this translates to a progressive overall tax code.

WRONG. We need to consider ALL of the taxes that are levied against ALL of the sources of income that are taxed. When we consider property taxes, sales tax, state income tax, capital gains tax, payroll tax, social security taxes, local fees and a myriad of other small taxes, we find that as a percentage of income, tax are the HIGHEST for the middle class.

If you remember during Mitt Romney’s campaign, he famously stated that “47% of the population pay no taxes”. He was referring to Federal income taxes, and in that regard he was technically correct, but intellectually dishonest as no citizens are completely avoiding Uncle Sam.